The federal government will soon begin issuing recovery rebates to qualified individuals under the Coronavirus Aid Relief and Economic Security CARES Act of 2020 the Act. I know the law.

Sternberg Has Dedicated His Legal Career to Helping Homeowners in Need Call Now.

. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Debtors Request LBR 3015-1q1 provides the procedure for a chapter 13 debtor to request a court order dismissing the bankruptcy case. Chapter 13 plan extensions The Act allows chapter 13 debtors whose cases were confirmed on or before 32620 and who are experiencing or have experienced material.

This includes the voluntary petition for non-individuals and individuals and Ch. Speak to a Lawyer Now. Congress enacted the Cares Act to help Americans that are struggling due to the spread of the Coronavirus Covid-19.

Ad We Have Decades of Experience Working for Clients. Chapter 13 Plan Payments CARES Act. Therefore Chapter 13 plans may be subject to modification and potential extension up to seven years provided they were confirmed prior to enactment of the COVID.

101 10A B ii to expressly exclude payments made. However we know no grace period lasts forever and you are likely eager to have a plan for the remainder of your Chapter 13 bankruptcy. Ad If You Are Facing Foreclosure We Provide Foreclosure Defense Get a Free Consultation.

Join Over 1 Million People Who Saved Thousands in Legal Fees Through Unbundled Legal Help. The CARES Act changed Chapter 13 bankruptcy rules by extending these plans from three to five years to up to seven years. Ad File Chapter 13 For 500-1500.

Join Over 1 Million People Who Saved Thousands in Legal Fees Through Unbundled Legal Help. For cases under chapter 7 and 13 the CARES Act modifies the definition of current monthly income in 11 USC. Ad File Chapter 13 For 500-1500.

The limit on chapter 13 cases before the Cares Act was 60 months. Speak to a Lawyer Now. For both Chapter 7 and 13 bankruptcies the CARES Act modifies the definition of current monthly income in the Bankruptcy Code to exclude the payments made under the.

It expressly permits individuals and families with cases pending under chapter 13 of the Bankruptcy Code to seek payment plan modifications if they are experiencing a material. To file a chapter 13 bankruptcy case in the Central District of California debtors. The CARES Act allows chapter 13 debtors to extend the length of a confirmed plan to 84 months.

The CARES Act amended the Small Business Reorganization Act of 2019 SBRA to increase the eligibility threshold for businesses filing under Subchapter V of Chapter 11 of. And missing payments can lead to your case being thrown out. One aspect of the law relates to Chapter 13.

Law Offices of Michael Jay Berger Bankruptcy Attorney I represent debtors and creditors in Chapter 7 11 and 13 bankruptcy proceedings throughout Southern California. 7 11 13 Statements of Current Monthly Income. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

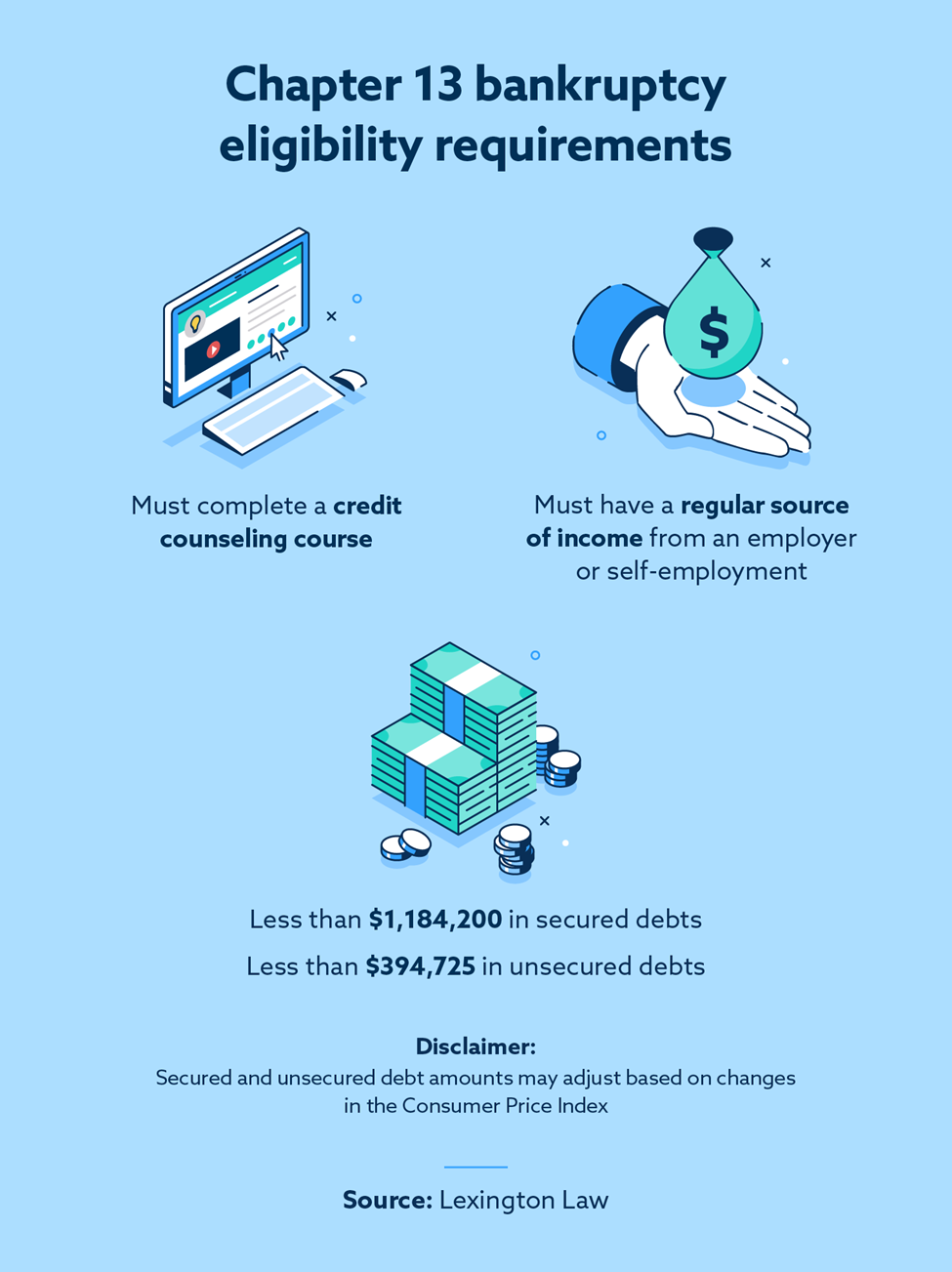

1 MUST complete an approved credit counseling course within 180 days BEFORE filing the bankruptcy. At this time the only legislation to be.

Do I Qualify For The Chapter 7 Means Test Chapter Bankruptcy Test

What Happens In Chapter 13 Dismissal Flexer Law

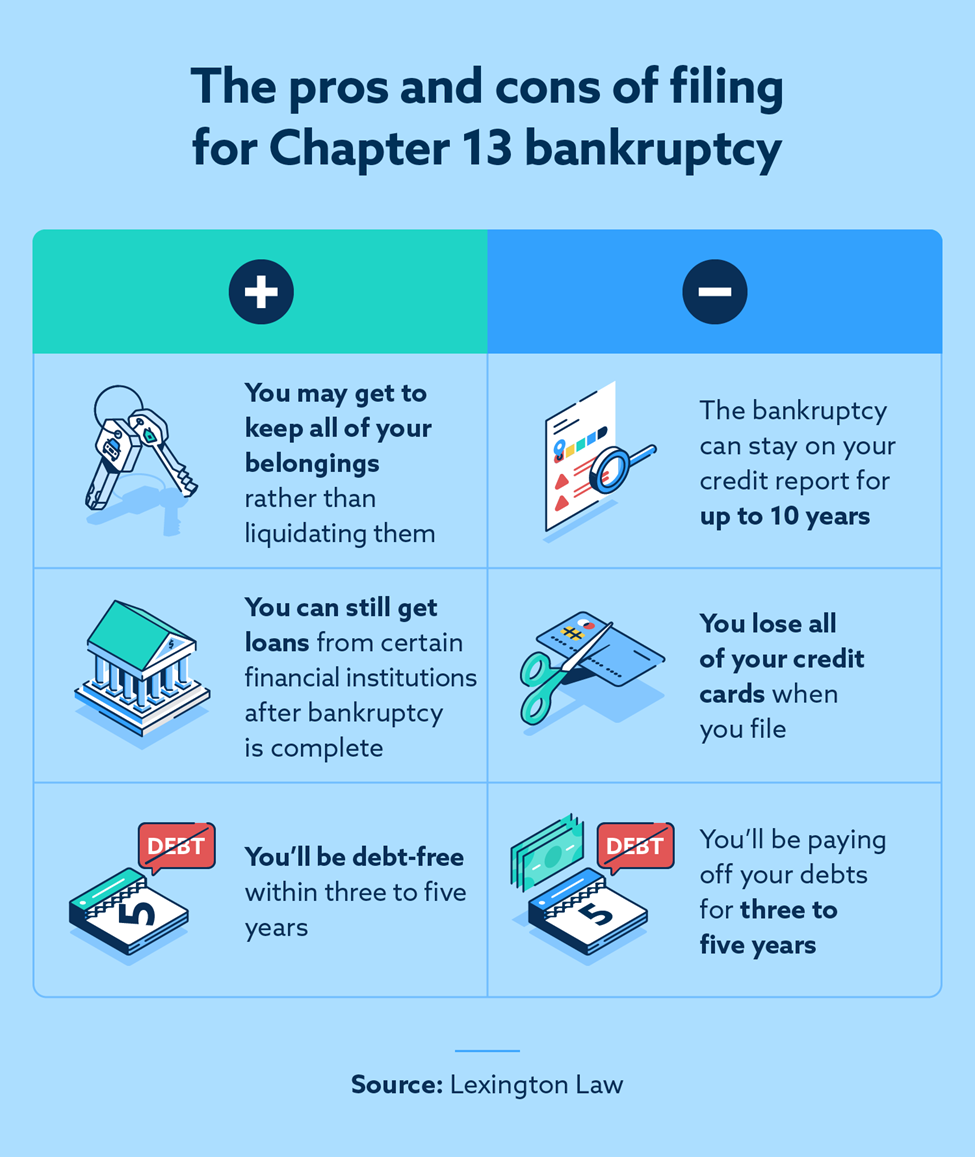

What Is Chapter 13 Bankruptcy Lexington Law

Cares Act Chapter 7 13 Consumer Bankruptcy Impact

Chapter 13 Bankruptcy Lawyer In Plano Tx Demarco Mitchell Pllc

What Is Chapter 13 Bankruptcy Lexington Law

Covid 19 And Your Chapter 13 Repayment Plan Steinberger Law

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy Experian

0 comments

Post a Comment